上周末时,市场还在担心第三次世界大战是否即将打响,风险资产已经小幅转向避险。美元走强,黄金反弹避险。而周末结束时,原油从暴涨到暴跌,以色列、伊朗的冲突,以及美国的介入,一切都以迅雷不及掩耳的速度演绎后,三方各自宣布“赢麻”了。

市场过去一周的反应说明,市场认为以伊冲突是短期的干扰,不会对地缘政治局势产生任何持久影响。伊朗在这场冲突中基本上是单打独斗,笔者在6月16日的文章中笑言道:“……这时,市场很可能在期待另一个TACO(Tehran Always Chicken Out,德黑兰总是怂)……”,没想到一语成谶。伊朗虽然也“赢麻”,但是他们TACO并不令人吃惊,而该地区紧张局势的缓解,反而提振了市场的风险情绪。在过去多条战线同时拉锯战的大背景下,这次的速战速决确实令人印象深刻。

本周的焦点仍然在美联储。美联储6月重磅会议的涟漪还在持续。其点阵图显示今年降息两次,这也是期货市场的定价,但明显感觉到美联储和特朗普之间的政治斗争开始白热化。

笔者上周指出,点阵图上反映出来美联储内部的斗争。从最近的一些官员的演讲和言论中可以推断出多位成员仍然不急于降息。同时,沃勒和鲍曼公开表示支持降息。这个现象十分有趣:这两位的美联储位置是特朗普提名的,而他们目前的表态也是特朗普想要的。尤其是鲍曼,过去的她是一贯鹰派的,她的转向不得不引起市场关注的……

上周,鲍威尔在众议院金融服务委员会作证时,为不降息的利率政策做出了强有力的辩护。他认为,“如果不是关税,美联储可能会继续降息”,延迟进一步降息是由于对关税对通胀影响的担忧,言外之意是,特朗普自己的贸易政策限制了美联储降息的能力。信息很明确:如果特朗普想要降低利率,他应该重新考虑他的关税政策。

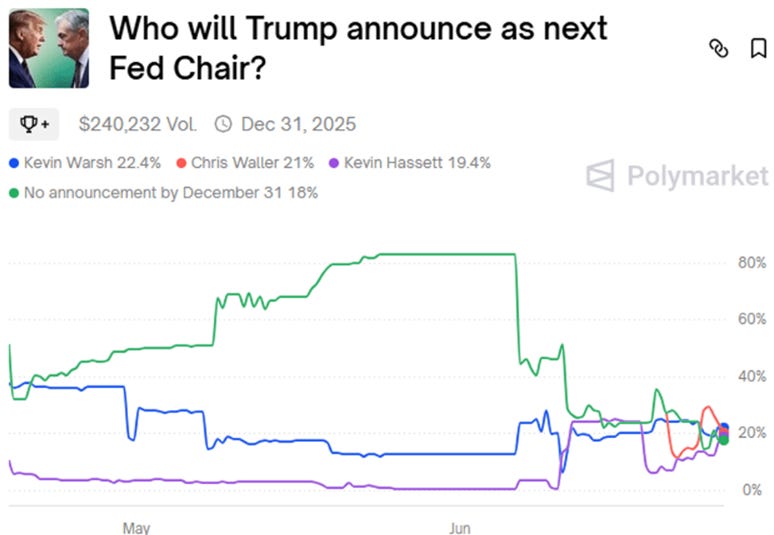

我们自然而然需要聊聊美联储主席的未来人选问题。随着美联储与特朗普之间的政治斗争进入高潮阶段,市场开始密切关注并进行相应的定价调整。下面这个polymarket的预测说明人们认为特朗普在今年年底前宣布人选的概率已经高达80%。

本周《华尔街日报》战略性的“独家”报道,值得一读。文章首先给出了目前榜上有名的三大人选:沃史(Warsh前美联储理事);哈塞特(Hasset前白宫经济顾问);贝森特(Bessent – 美国财长,笔者不明白为什么他财长当得好好的,为何愿意去很可能被边缘化的部门当头?)。微妙的是,沃勒的名字直到文章的第三段才出现,显然,这位向《华尔街日报》透露消息的通天人士并不认为沃勒或是鲍曼当选的概率会非常大。

无论是谁,市场也做出了判断。下图为2026年3月和6月SOFR期货(隔夜逆回购的相关利率)之间的差值。这么远的两份合约之间很少见如此大的差价:相当于一次25个基点降息的幅度(而图上显示2025年1月时两者差价为零)。

市场知道鲍威尔的任期于2026年5月结束,新的美联储主席走马上任。特朗普和万斯在这个问题上的言论,给市场几乎没有留下任何想象空间 --- 新主席将降息。这就是为什么这两个期限的合约之间的价格正好差一次25基点的降息!

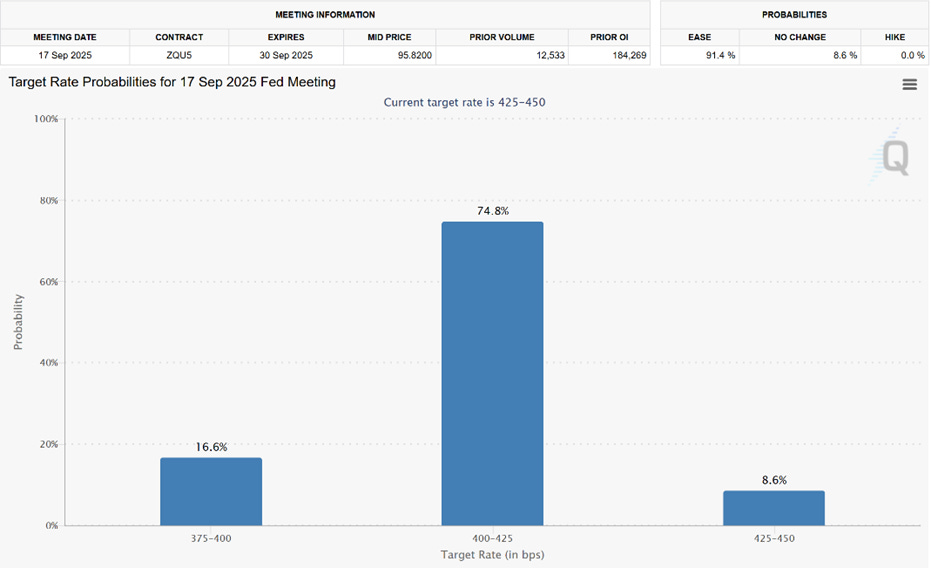

而市场目前可以说是越来越肯定,7月份小概率降息(CME Fed Watch的概率在18.4%,7月初的非农就业数据将对这个概率有很大的影响),9月份降息的概率目前则高达75%(见下图)。

事实上,美联储降息的理由早已充足(不过,单纯从目前的服务和租金通胀来看,确实也还没有回到疫情前)。之所以等待,大概率是因为没有看到想看到的。关税的冲击会不会还在路上?该涨的可能已经涨了。不涨的,应该在被企业消化中。随着7月9日期限的逼近,特朗普政府又放出继续“TACO”的风声……鲍威尔多半在7月的数据中还是看不到想看的,那么他会不会以特朗普“TACO”为由降息,找个台阶下算了?

仍然很有韧性的就业市场和美国财政刺激政策的助力下,美股在过去的一周创出了新高。下周开启2025年的下半场。

过去的上半场中,市场人士偏熊是共识,大致出于以下两点:1)关税造成的“美国例外论”的结束;2)2025年科技盈利下降的预期。针对前者,“TACO”使得市场重拾对美国科技股的信心;而谷歌的上季度财报重燃了人们对人工智能资本支出趋势的希望,扭转了后者。

统计上来看,标普在5月和6月涨势良好,今年剩下月份表现好的概率就很高(见下图)。如果单看7月的话,过去10年中,标普500指数基本是上涨的。市场的风险偏好持续升温。

下半场,如果机构仍然低配风险资产的话,会不会被迫追涨?

当然,我们知道市场的宽度在继续变窄,集中度增加(见下图),某种程度上,与去年6月底7月初类似。笔者在去年同期的文章中对市场宽度对市场上涨的影响,以及市场将会如何演绎,进行了讨论。各位读者不妨可以参考。

现在的关键是,市场还会不会再给我们一次经济增长“惊吓”的机会,来逢低买入?那就可能在Q2财报前后。

免责声明:本文所提供的所有信息和相关产品,不论是何种性质,都不应视为在建议、诱导或鼓励公众买卖任何股份、股票期权、相似金融产品或其他任何金融工具。不论读者如何使用本文提供的信息和相关产品,或是根据这些信息做出了有关买卖股份、股票期权和其他相似金融产品的何种决定,读者必须独自承担责任。本文提供的任何信息均不构成针对个人的投资建议,也不构成任何法律、会计、税务或其他专业建议。本文部分图片来自网络。

The drag of Tariffs talks will prolong the inflation expectation. FOMC cannot play the TACO game i.e. lowers rate as inflation drops temporarily and raises rate suddenly when inflation rises as Trump suggested. When May PCE(yoy) and Core PCE(yoy) started to rise after 2 months decline , FOMC will definitely switch on the wait and see mode. July is not the time to cut rate and even September if PCE data continues to rise provided that GDP is above 1.4% and unemployment rate is below 4.5%. Because the primary mandate of a central bank is to tame inflation and growth is of secondary concern.

When US ten years yield finishes its correction and starts to rise above 4.6%, stock market will take its turn for the correction.